Since the pandemic’s beginning, the real estate industry has faced numerous problems and setbacks. It has become harder for real estate professionals to broker property sales. Demands kept changing, and the market experienced some of the biggest nosedives in almost a decade.

Anytime demands to drop or the real estate market becomes volatile, real estate commissions are the first to experience slashes and cutbacks. As a result, earnings have significantly dropped for real estate professionals in the last two years.

Unsurprisingly, most professionals have faced cash flow issues due to reducing the number of real estate deals and sales. Commercial property dealers have been hit the hardest, as the work from home culture resulted in a steep decline in office leasing activity.

With new harmful variants emerging and a tight, volatile market, real estate professionals must remain prepared for any unexpected issues in the future.

Hence, we have come up with cash flow management for real estate professionals. So, you won’t have to experience major financial disruptions for whatever reason.

Cash Flow Management for Real Estate Professionals

The best way to tackle unexpected hits on your income and wallet is to have a proactive approach to money. Here is how you can make that happen.

Set Up A Cash Flow Plan and Budget

Creating a robust cash flow plan and a tight budget are essential for managing an unsteady income and your overall expenses. It is important to set up a plan and budget for the entire year, rather than just the next month, because it demonstrates a long-term commitment to the plan that isn’t another one-off thing.

Naturally, you will need to keep going back to your plan and budget to make any necessary adjustments as the year unfolds. However, this should not be an excuse to stretch your budget regularly. What you should do instead is create contingency plans in your budget.

These plans will help overcome any unexpected hurdles that may come up during the year. As for your cash flow plan, remember to include your projected income for the year and overall expenses. So, you have a clear and accurate overview of your yearly income and expenditure.

Most importantly, as a real estate professional, you must account for the seasonal trends of your real estate market

when drawing up your yearly cash flow plan. Determine how they may affect your cash flow positively or negatively and plan accordingly.

Take a Realistic and Conservative Approach

Determining your yearly income, expenses, and cash flow forecasts is difficult and rarely accurate. However, this does not mean it has to be way off the charts. Often, it is easy and tempting for real estate professionals to look at the market optimistically and forecast greater commissions.

While there is nothing wrong with being optimistic or predicting upward market trends, you need to be as realistic as possible when creating your cash flow plan. Consider your work and your real estate business’ position in the market. This includes evaluating your current and future positions.

Ideally, you want to be conservative with your market forecasts and income projections. This will help you create an airtight plan. If you do end up finding yourself with a surplus of funds, you can put it in your savings and investments or use them for your cash contingency plans.

Religiously Track Your Income and Expenses

Any financial management, including cash flow management, requires consistent and meticulous money tracking. As a real estate professional in an uncertain market, you need consistently track all your income and expenses, no matter how small they may be.

For good cash flow management, every dollar counts, and you must know exactly where and how you spend your money. A bag of chips or a can of soda from the vending machine may seem trivial, but it is crucial when you need to account for every dollar spent.

Similarly, if you are to follow your budget and not overspend, you need to know where the money comes from and where it goes. Without this, accurate budgeting will become impossible. A simple technique is to create a digital note on your smartphone for when you spend small, insignificant amounts of money.

You can tally them later in your actual plan when you review your budget at the end of each month. At this time, pay close attention to overheads and fixed costs. This will help you find ways to cut costs and save money on a few things.

Hope for the Best, Plan for the Worst

It is a great idea to draw plans for the best and worst scenarios when creating your forecast and cash flow plan. It allows you to cover your bases and be prepared for anything that may come up. However, it is best to do this once you have already created your plan and budget.

This way, you can use your existing cash flow plan as a guide for planning extreme scenarios. A good rule of thumb is to plan 20 percent higher for the best-case scenario and 20 percent lower for the worst case.

Don’t Forget About Taxes

It isn’t uncommon for a layperson to forget to include taxes in their financial management plans. This can be problematic because taxes will always come around to bite back, often with penalties. Be sure to include taxes in your plan so you never accidentally upset the IRS.

As a real estate professional with cash flow concerns, you should pay taxes every quarter instead of once a year. This will make taxes more manageable, less daunting on your budget, and prevent any chances of penalties. Moreover, quarterly tax payment means you’ll deal with less paperwork.

Conclusion

More than anything, cash flow management for real estate professionals requires dedication and foresight. You need to commit to your budget and prepare for the best and worst things to come. Track everything and pay your taxes, so nothing goes amiss.

Following the mentioned financial planning guide and proactive approach, you should be on your way to excellent cash flow management, even during market downturns and slow seasons.

Who We Are

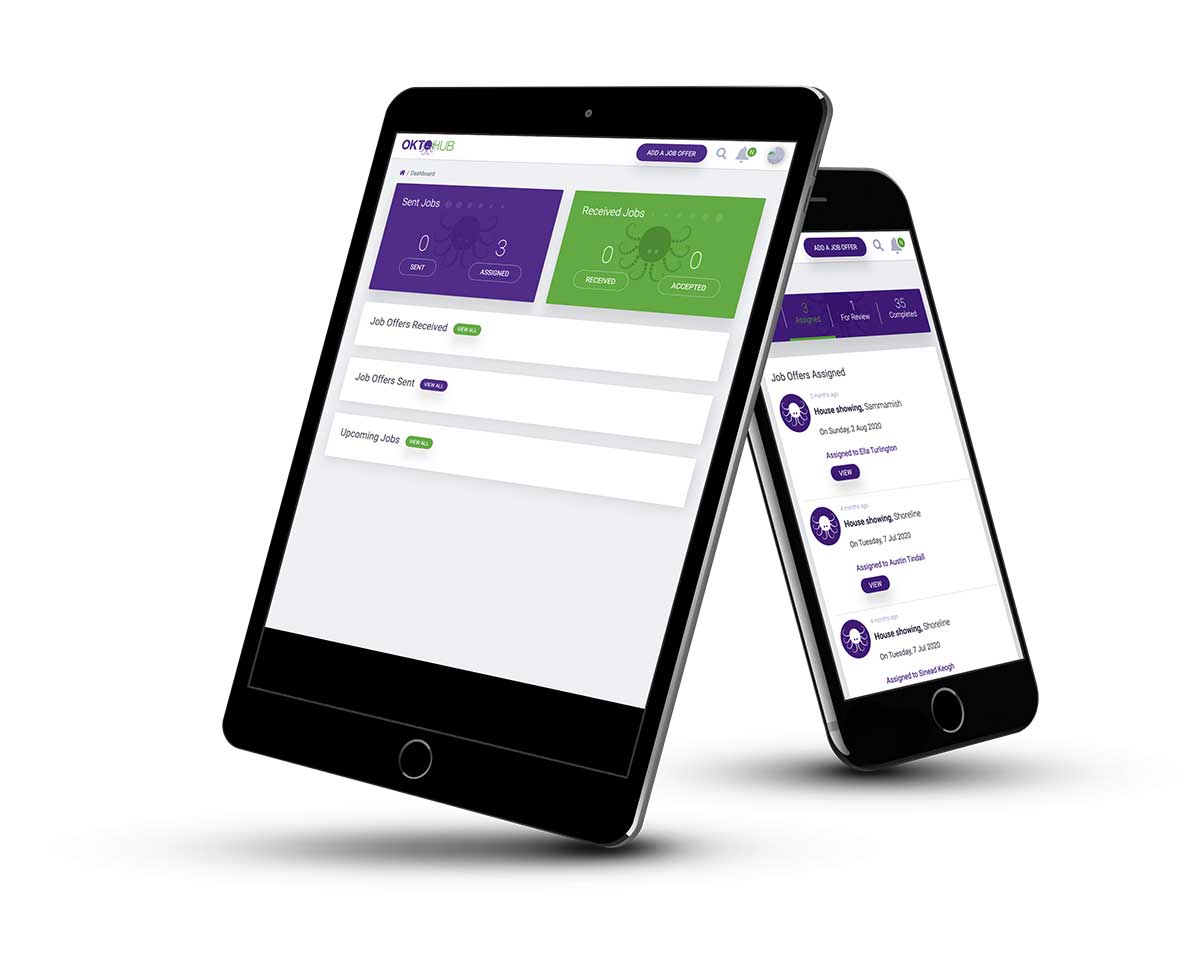

OktoHub is the first-ever on-demand real estate assistance program to help real estate professionals manage a better work-life balance. It allows you to create a network of trusted real estate professionals around you, who you can hire for task-based jobs.

You only pay for the task at hand, which means you won’t have to commit to a permanent hire or pay monthly salaries. OktoHub ensures that you never have to give up on clients in the competitive real estate market.

Similarly, you won’t have to give up on your family or personal time. OktoHub allows you to get on-demand real estate assistance, where you can hire trusted professionals for real estate tasks like showings, client meetings, home inspections, staging, and much more.

Why compromise on your clients or family time? Start building your network on OktoHub today and reap the benefits for life.

If you want to learn more about cash flow management for real estate professionals or about the networking and real estate benefits of OktoHub, please visit our website today.