To rent or to buy?

Renting vs. buying is an age-old debate and most people around the world have already picked their sides or at least have a strong opinion or favor toward one side. It may not come as a surprise that the side most people prefer is buying.

This does not always mean they are right. Anyone who was hit hard when the housing bubble burst back in 2008 can testify that buying does not always go according to plan.

Let’s discuss renting vs. buying and find out what the true costs, risks and returns are by assessing the pros and cons.

Renting

Renting a home is when you sign a contract to pay ‘X’ amount of money every month, which typically covers repairs and maintenance of the home as well. Once your contract ends, you can renegotiate or move on to another home without any penalties or extra costs, except maybe some moving costs.

This is not a bad deal at all, however, if the owner suddenly decides to sell the property or increase the rent, it could mean that you will have to abruptly move homes before you anticipated. One misconception that most people have is that renting is a waste of money because you get no home equity.

This is far from the truth because everyone needs a home to live in and they pay for it one way or another. Renting is just another form of paying for a home to live in. As for equity, not all the expenses of owning a home will add to your equity.

Renting gives you flexibility in your budget because you can work out how much more or less you want to pay for housing each month. You will also never have to pay unexpected costs on expensive repairs and maintenance from time to time.

Whereas a homeowner may unexpectedly have to pay thousands of dollars for repairs and maintenance of the home, your renting costs are lesser and more predictable than those of a buyer. Buyers also have to pay for increasing taxes and insurance.

The unexpected costs renter’s face are a little different. Unless you have rent control, your rent may go up significantly if the demand of your neighborhood increases when your contract is about to end. Home renters also face less risk than home buyers.

If the property does not gain value overtime and costs the same at the end of the mortgage period as it did when bought, it means that the buyer has lost a significant amount of money to inflation, maintenance and opportunity costs.

Whereas, a renter does not have to bear this risk, which seems fair considering they have no equity in the home they rent if its value goes up. It is a no risk no reward situation for renters and can be the logical move for someone who wants to avoid taking big risks.

Additionally, renters have a huge advantage in flexibility in lifestyle – they can travel, go out on weekends and have a lot more free time than buyers. Buyers have to regularly spend time on maintenance and cannot leave for extended periods without a caretaker in place.

Pros

- Predictable costs without much fluctuation.

- Free repairs and maintenance.

- Flexibility in budget and lifestyle.

- No interests or high taxes.

- Low risk.

Cons

- No ownership.

- No equity overtime.

- Will always have to rent housing till you buy.

Buying

Buying a home has indefinable benefits like ownership, stability and a sense of community and this can be great for people who want to permanently settle down in a fixed location. This means that buyers cannot just change their locations when they feel like it.

Homes are not always easy to sell, especially if the market is down, and you will not have the flexibility of changing your location as renters do. On average, the overall costs of buying and owning over a long period of time is much more than that of renting a home.

Buyers pay for more than the mortgage interests and taxes overtime. They pay for repairs and maintenance, home insurance, other applicable insurance, like flood or earthquake and utility. To think that buying is a stable, onetime expense is a grave misconception that can bleed finances horribly.

These added costs make it painfully obvious what the true cost of ownership, stability and community are. Most people who do not have the time and money to cover all the bases of buying are much better off renting and investing the difference in a retirement account.

The only real and tangible benefit of home ownership is in equity, if the property value increases overtime and you make a significant profit. This is a high-risk situation, which is why buying is mostly suitable for those who are more committed to the property rather than its monetary value.

Buying is either for investors who know how to turn a profit, through renting or flipping, or for people who are looking to settle in a place they want to call home.

Unfortunately, buying is also increasingly becoming out of reach for renters today. Between 2016 and 2019, there was a 15 percent increase in American renters who believed renting is more affordable for them than buying.

Pros

- Pride of ownership and a sense of community and stability.

- Eliminates the cost of housing once the home is paid for.

- If the value rises, you break even or make a profit on the overall expenses.

Cons

- Pay more in taxes, interests and insurance.

- Opportunity cost of buying.

- Time and money spent on repairs and maintenance.

- Little flexibility in budget or lifestyle.

- If the value declines, you lose money on expenses.

- High risk.

Conclusion

Renting vs. buying is not always about money and it can depend on your choice of lifestyle as well. When money is involved, there is always risk and the risk of buying is much more than the risk of renting, which is why there is a major difference in the rewards as well.

Renting has no significant reward apart from flexibility, whereas buying can be a good long-term investment. The problem is that a home is a purchase and not an investment, so thinking that you are investing in buying a home is not the best approach.

In truth, the cost of buying is significantly higher than renting and if you plan on buying then be aware of all the time and money you will be investing over a period of time. Even with all the risks, people may choose to buy simply for reasons like raising children or building a family home.

Sometimes renting can be much smarter than buying and vice versa. It all depends on a number of factors and instead of arguing about renting vs. buying, you should study the factors before you make a decision that is right for you.

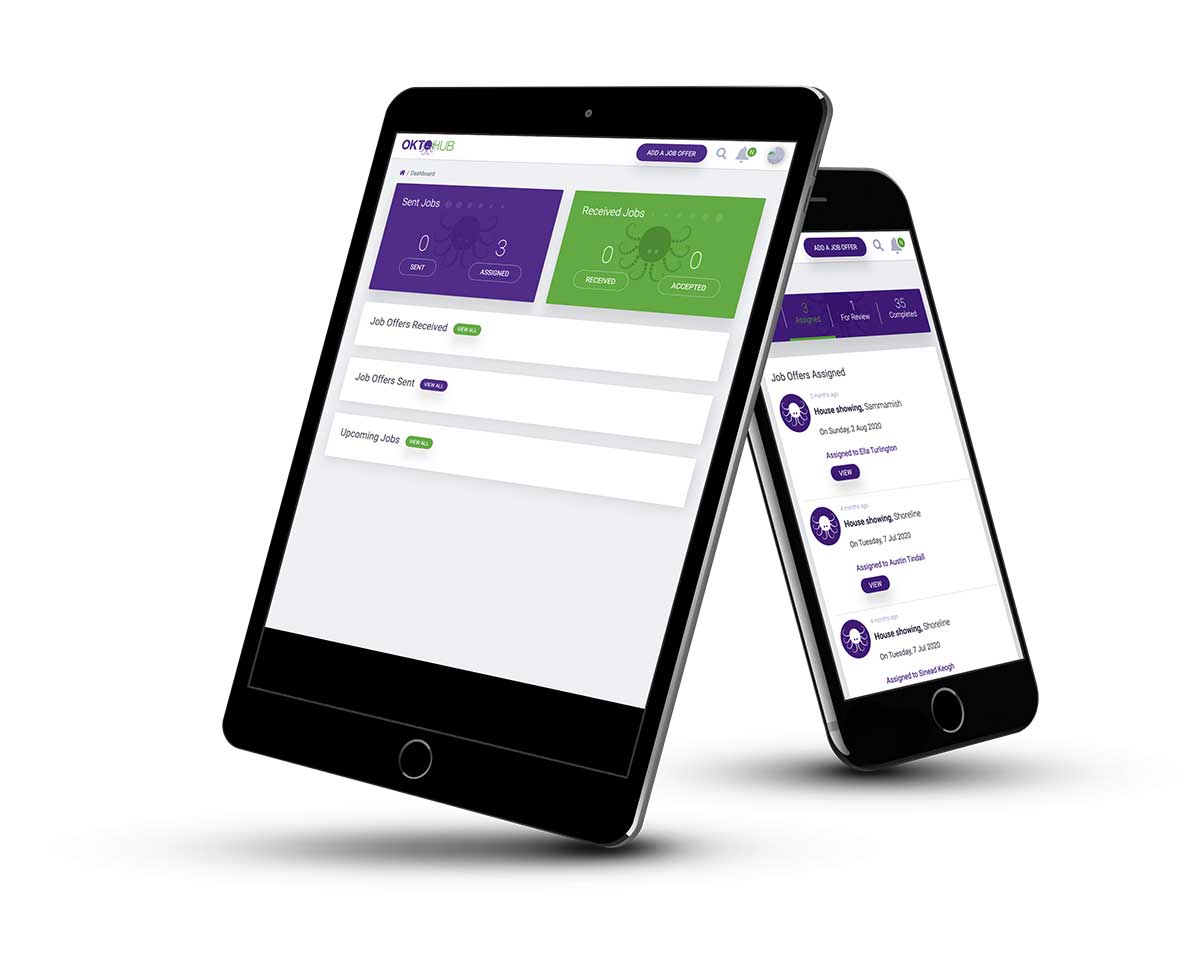

If you want to learn more about renting vs. buying and real estate, please visit the OktoHub website.

Oktohub is the first ever on-demand real estate assistance program that helps you build a network of trusted and reliable real estate professionals around you. You will never have to trade your time for money again and still grow your business without passing up clients.